In accordance with Section 2 of Service Tax Act 2018 imported taxable service means any taxable service acquired by any person in Malaysia from any person who is outside Malaysia. Search OFACs Sanctions Lists.

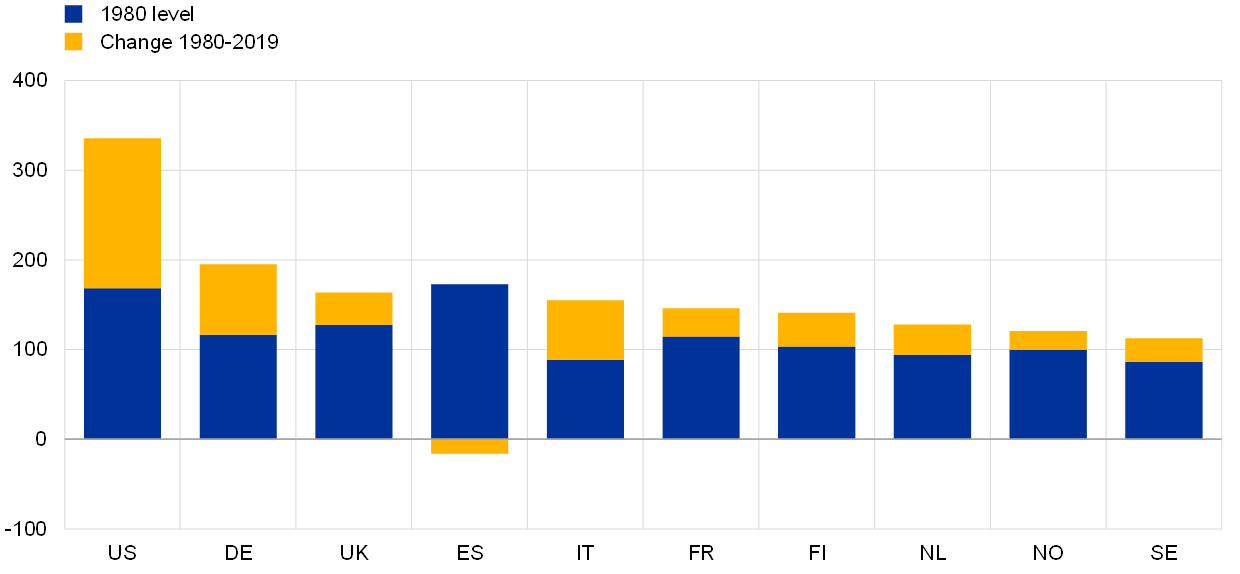

Monetary Policy And Inequality

HOWEVER the tax exemption which was gazetted as the Income Tax Exemption No.

. Box 10192 50706 Kuala Lumpur Malaysia Tel. Net Direct Tax collections for the Financial Year 2022-23 grown at over 45 Net Direct Tax collections for the FY. 4 ms Extreme ModeRefresh Rate.

Filing of Return and Tax Payment SST Registrant. Sanctions Programs and Country Information. With effective from 1 January 2019 imported taxable service is subjected to service tax.

2022-23 stand at Rs. So does this mean there are no. What is current practice YA 2019 and before.

For comparison Singapores carbon tax comes in at an introductory rate of S5 RM1538tCOe until 2023 while Japans tiered carbon tax starts at 289 RM1081tCOe. According to the IRB this data is based on information through the ownership of assets and the ability of. Xepasp Apex Pharma International and Corporate.

Has received following invoices for financial year end is 31 December 2020 and made payment as follows. 75 Hz HDMI inputBrightness250 cdm2Contrast Ratio. 100011 x HDMI v.

Up to 31598 individuals and entities have failed to disclose their actual income with the IRB. Section 80C of Income Tax Act 1961 allows tax benefits of upto Rs. 2145 FHD 1920 x 1080 VAPanelResponse time.

Tax Ktp Ktp December 30 2020 SME tax rate. Apex Healthcare Berhad is a leading regional pharmaceutical group with operations in Singapore Malaysia Vietnam and Indonesia. Box 10192 50706 Kuala Lumpur Malaysia.

KTP Company PLT. SME Tax Rate Malaysia 2020. Muamalat Invest Sdn Bhd MISB is a wholly-owned subsidiary of Bank Muamalat Malaysia Berhad.

Articles of association and memorandum must be submitted if the organisation falls under Sdn Bhd. Voluntary Provident Fund Tax Benefits. PricewaterhouseCoopers Taxation Services Sdn Bhd 464731-M Level 10 1 Sentral Jalan Rakyat Kuala Lumpur Sentral PO.

2 Order 2019 was only for a period of one year from 1 January 2018 to 31 December 2018 and has now expired. Therefore there is neither an exchange gain nor loss for ABC Sdn Bhd. Muamalat Invest a licensed Islamic fund manager has been a licensed fund management company since 2006 and was accorded the Islamic Fund Management license in September 2010.

The interest generated from VPF contributions is tax-exempt as well. Specially Designated Nationals List SDN List Consolidated Sanctions List. Publicly listed on the Main Board of Bursa Malaysia Apex Healthcare Berhad is an investment holding company with four key business groups.

The Penang Institute in its 2019 proposal for carbon tax in Malaysia proposed an introductory rate of RM35 per tCOe before rising to RM150tCOe by end-2030. To open a corporate account with GD Express please click here or kindly contact our Sales Desk at 03-64195003 or email. Founded in 1962 our core expertise is in the.

Taxability and Deductibility of Foreign Currency Exchange Gains and Losses In order to determine whether a business entity is subject to tax on its foreign. Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. 53 Jalan Molek 18.

The JPJ data also revealed that there were 168 million licenced drivers in 2019 a 105 increase from the 152 million that was registered in the database in. 1562019 but if the exchange rate on 1562019 was RM420 USD1 again the RM equivalent for UDS10000 was RM42000. 2022-23 continue to grow at a robust pace further fortifying the economic revival Gross Tax collections for the Financial Year 2022-23 grown at about 40 Advance Tax collections for FY.

Call for Pick-Up Contact our Pick-Up Hotline at 03-64195003 and we will pick-up your parcels at your doorstep. RM 44900 Ex TaxRM 44900 Add to Cart. THE Inland Revenue Board IRB gives one month period from today June 15 until July 15 this year for 31598 individuals and business entities to report their actual income.

Published by PricewaterhouseCoopers Taxation Services Sdn Bhd 464731-M Level 10 1 Sentral Jalan Rakyat Kuala Lumpur Sentral PO. Locate GDEX Drop by at any of the nearest GDEX branch lodge-in center OR visit our Reseller Agents Outlets at your convenience. 15 lakh per annum.

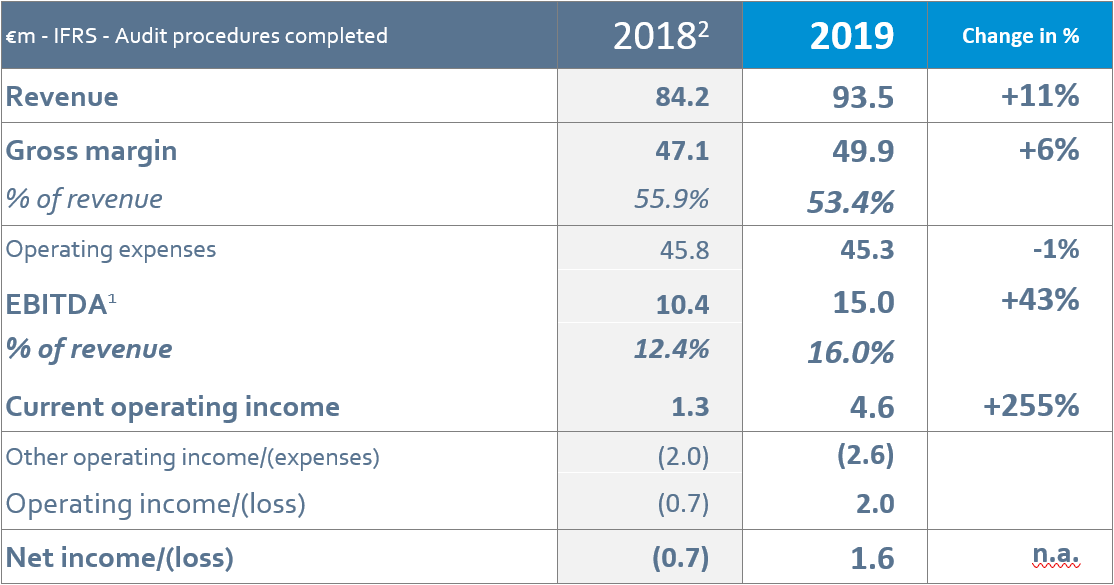

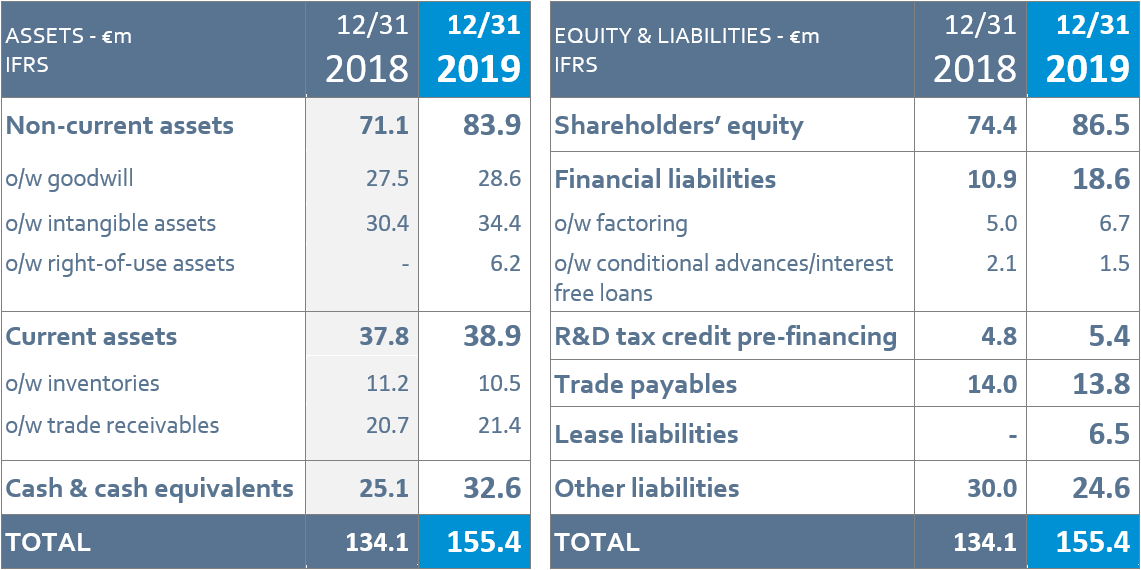

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

Personal Income Tax E Filing For First Timers In Malaysia

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

T20 M40 And B40 Income Classifications In Malaysia

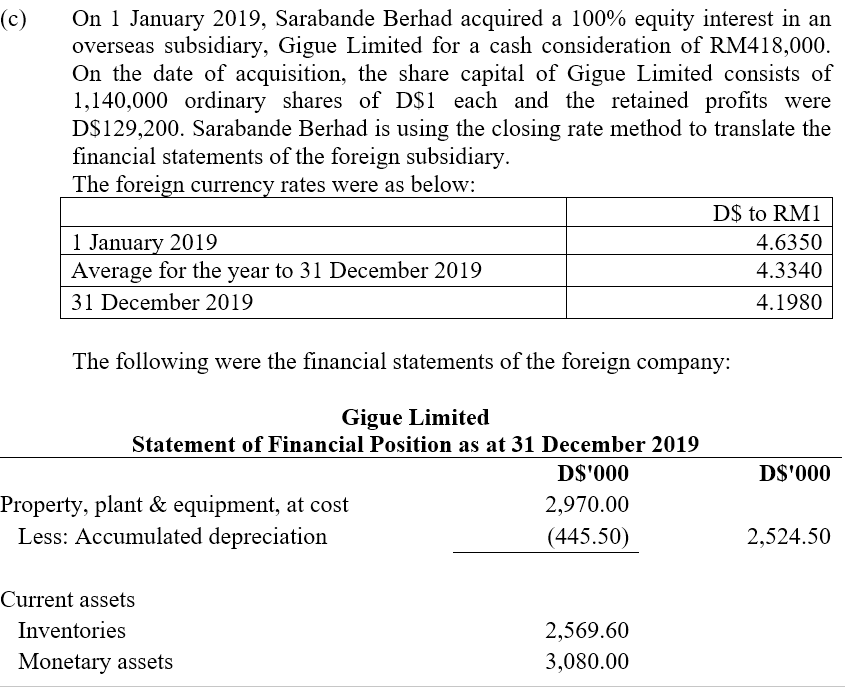

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Sustainability Free Full Text Dynamic Coordination Of Internal Displacement Return And Integration Cases In Ukraine And Georgia Html

Reliance Annual Report 2019 2020

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Case Study Of Top Glove Corporation Bhd 7113 Shareinvestor Academy Malaysia

Malaysia Budget 2019 Highlights Mypf My

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

10 Things To Know For Filing Income Tax In 2019 Mypf My

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Malaysia Maxis Bhd S Total Revenue 2021 Statista

Sustainability Free Full Text Acid Soils Nitrogen Leaching And Buffering Capacity Mitigation Using Charcoal And Sago Bark Ash Html

Malaysian 2019 Vehicle Sales Performance Compared To Other Asean Countries Indonesia Remains Top Paultan Org

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting